Chloe Quigley, Business Exit Planning Advisor

If you have a piece of highly appreciated property, you may be considering what’s next. You may have heard the saying “swap ‘til you drop” which traditionally refers to continuing to do a 1031 exchange with a property until your passing and your heirs receive a step up in basis. But are there more options to defer capital gains with your real estate? And how can you know which one is the right for you? Might there be options to defer taxes on gains of other investment assets as well?

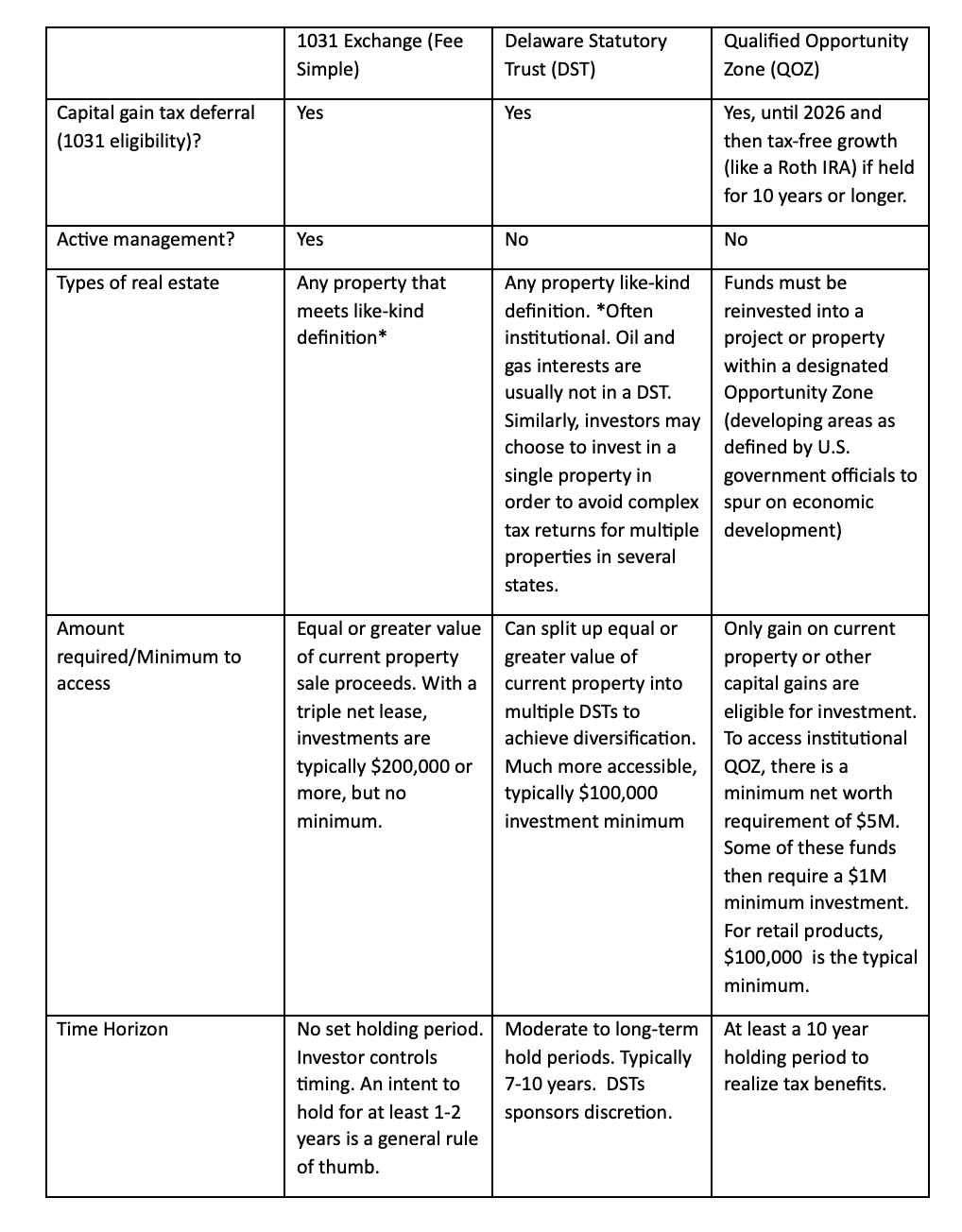

To give you a breakdown of these options, we’ve put together the chart below.

* Like-kind refers to the nature of the investment. Any type of investment property can be exchanged for another type, or like-kind investment property. For example, a single-family rental can be exchanged for a duplex, raw land for a shopping center, an office for apartments. Any combination works and provides investor with great flexibility.

To get a full understanding of which option fits best into your personal financial plan, it is best to talk with your trusted financial advisor. They can coordinate with your tax advisor to get an even clearer picture of your potential savings. Additionally, should you go the DST or QOZ route, they’ll be able to supply you with several proposals that demonstrate the options available to you. Investing in real estate has some obvious benefits, but there are additional risks as it pertains to illiquidity and varying hold periods.

What about REITS? If you’re wondering where REITs fall into the real estate investment option space, one thing to note is that REITs are not traditionally eligible for 1031 capital gain deferral, while there are some ways to do this through a DST. REIT investors are investing in shares of a company that owns multiple pieces of real estate – not the real estate itself. Also, noteworthy, REIT investments are usually much smaller than investments in DSTs or QOZs (as little as $1,000). They can be traded on the stock exchange and are a more liquid option for newer investors with a desire to diversity with real estate exposure.

Saving taxes while liquidating assets is really important. To understand what is the best option for you, it is best to lay out your entire plan with your trusted team to find a solution that meets you and your family’s goals and needs.

Chloe is a non-registered associate of Cetera Advisor Networks.

This piece is not intended to provide specific legal, tax, or other professional advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor.

Neither Cetera Advisor Networks LLC nor any of its representative give legal or tax advice.

REITs are subject to various risks such as illiquidity and property devaluations based on adverse economic and real estate market conditions and may not be suitable for all investors. A prospectus that discloses all risks, fees and expenses may be obtained from 847-304-1990. Read the prospectus carefully before investing. This is not a solicitation or offering which can only be made in conjunction with a copy of the prospectus.