Chloe Copple, CEPA, Business Exit Planning Advisor

The Setting Every Community Up for Retirement (SECURE) Act, passed in 2019, is now updated with follow-up legislation, making the SECURE Act 2.0.

What do you need to know as a business owner about how this affects you and your employees?

First, let’s start with the problem.

You likely agree that it is important to save for the future. As an individual, you save for yourself, your family, and other loved ones. As an employer, you may also aim to give your employees the opportunity to do the same. Combined with the tax benefits of setting up retirement plans for your employees, these plans also allow you to be a more competitive player in the market place.

Meanwhile, a study of 500 small business from across the country found that only 26% of those surveyed offered 401(k) retirement plans. This is affecting most Americans. Perhaps, it is affecting your own employees.

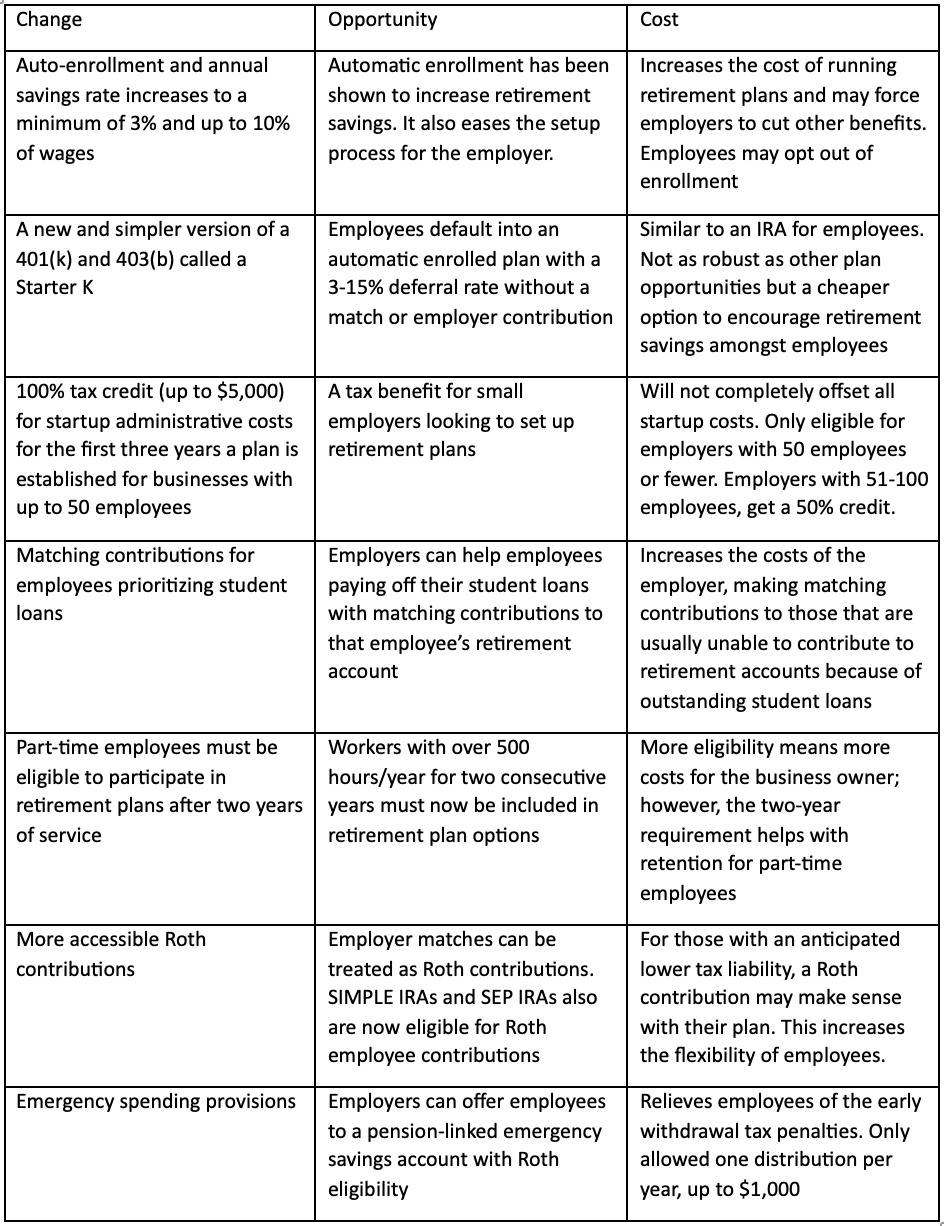

Either way, the SECURE Act 2.0 affects you and may change how you think about, talk about, and implement these plans for yourself and your employees. Let’s look at some of these changes together.

Remember, there are exceptions and limitations to these rules and their impacts. The above chart is a starting point to get you thinking about these ideas, but your situation and business are best supported with tailored advice to your needs. If you have questions about these changes and how they affect your current plan offerings, or the ones you hope to put in place, reach out to our team today.

Chloe is a non-registered associate of Cetera Advisor Networks.

Sources:

Hopkins, Jamie “The Complete Guide to the SECURE Act 2.0”

Buttle, Rhett, “SECURE 2.0: 5 Things Small Business Owners Need to Know” https://www.forbes.com/sites/rhettbuttle/2023/01/05/secure-20-5-things-small-business-owners-need-to-know/?sh=5dbe21c58bff