The Three Components of a Successful Business Exit Plan Strategy

Chloe Quigley, CEPA, Business Exit Planning Advisor What’s the most important thing when selling your business? Certified Exit Planning Advisors know that there are three equally important components of an exit plan:

Building Your Ideal Business Succession Plan

By Odaro Aisueni, CFP®, Wealth Planning Administrator As a small business owner, you’re likely so immersed in the routine functions of your business that you haven’t yet put much thought into the day you leave it behind. In fact, most small business owners have so much purpose t …

5 Common Business Exit Planning Mistakes (and How to Avoid Them)

By Elizabeth Schanou, JD, CExPTM , Senior Wealth Planner Succession planning – or more accurately “business exit planning” – is a critical process that has weighty implications for small business owners. There are two key goals: You want to ensure a seamless transition that will pres …

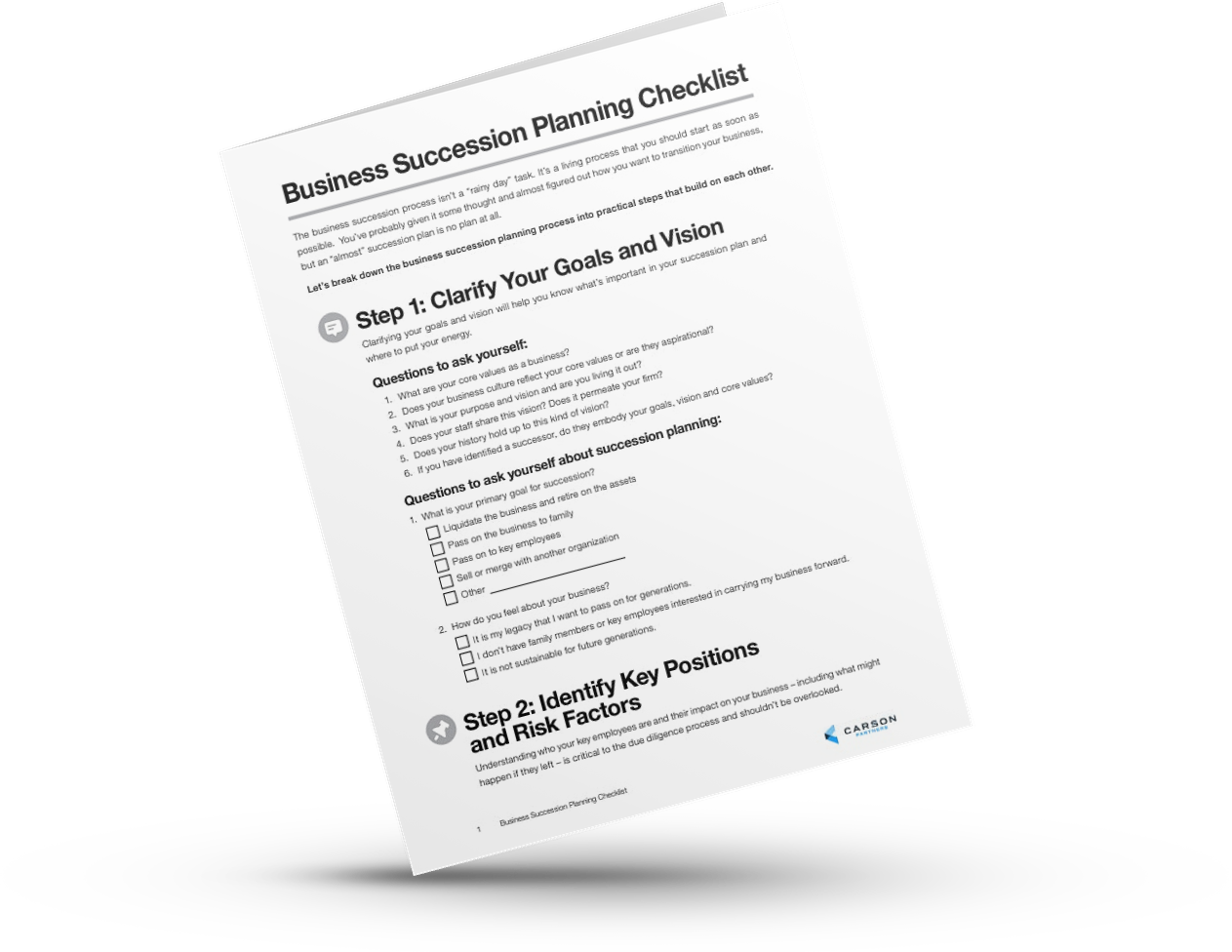

Business Succession Planning Checklist

The business succession process isn’t a “rainy day” task. It’s a living process that you should start as soon as possible. You’ve probably given it some thought and almost figured out how you want to transition your business, but an “almost” succession plan is no plan at all. Fill in the f …

Are You Offering a Competitive 401(k) Plan?

Chloe Copple, Business Exit Planning Advisor, CEPA Come November 2023 in Illinois, businesses with 5 employees (including part-time workers) are required to offer 401(k) plans.

Is a Qualified Opportunity Zone the Right Opportunity for Me?

Chloe Copple, CEPA, Business Exit Planning Advisor In 2017, the Tax Cuts and Jobs Act was signed into law, passing a new tax incentive called Qualified Opportunity Zones. This program certified distressed low-income communities throughout the United States to qualify for new federal tax inc …

Can I Use a Donor Advised Fund to Minimize Taxes in my Business Sale?

Chloe Copple, CEPA, Business Exit Planning Advisor Did you know you can get a charitable tax deduction, avoid estate taxes on a gift, and avoid a capital gains tax in the sale of your business through a donor advised fund (DAF)?

Planning Your Exit Strategy

When should you start planning your exit strategy? If you’re a business owner, your exit path should already be on your mind, no matter how far away it might be.

What’s the difference between a 1031, DST, and QOZ? And where do REITs fall in?

Chloe Quigley, Business Exit Planning Advisor If you have a piece of highly appreciated property, you may be considering what’s next. You may have heard the saying “swap ‘til you drop” which traditionally refers to continuing to do a 1031 exchange with a property until your passing and your …

Charitable Planning for Business Owners

Chloe Copple, CEPA, Business Exit Planning Advisor What does charitable generosity have to do with your company? Giving to charity has been engrained in my routine since I set 10% of my eighth birthday check aside for charity. I can understand how giving is a routine that takes diffe …

Should I Take on Debt as a Successful Business Owner?

Author: Chloe Copple, CEPA, Business Exit Planning Advisor Contributor: JJ Comiskey A lot of the business owners we work with are highly averse to debt. Having no debt can feel like a clean slate. It can symbolize a green light to move forward, whereas having debt can feel like a burden or …

COMPLIMENTARY RESOURCE

Business Succession Planning Checklist

You remember your first day of business. But what about your last day? Succession planning is more complex than it may seem. Our guide walks you through the details.