...

Business Owners

We understand the challenges of owning, building, and planning for the future of your business. Maximizing its value and ensuring a smooth transfer requires focus and extensive experience.

Do You Know These Statistics?

-

75% of business owners would exit today if their financial security were assured.

-

18% of business owners have talked to someone whom they consider an expert in exit planning

Our priority is to help you develop and implement a written plan that makes you feel secure, confident and excited about the next chapter – for you, your loved ones, and your business; at the same time, increase your profitability.

Do you know your gaps?

You have a lot on your plate.

It is important to take a step back and look through an additional lens. You know your business, but you may not know how to eliminate these gaps. Our goal is to come alongside you, creating and acting on a plan to increase your profits and the value of your company while maintaining your core values and working towards your long-term goals.

Take a moment to think about the impact of closing these gaps. Increased profits. Higher valuation. A more successful future.

While we’re helping you think about the future, we’re also going to help you increase your revenues and protect what you have built now.

Our process incorporates relationships with strategic partners to take you all the way through business valuation to identifying opportunities and risks. We will see your transition through its sale and into the next act of your life, while working towards your financial, personal, and business goals.

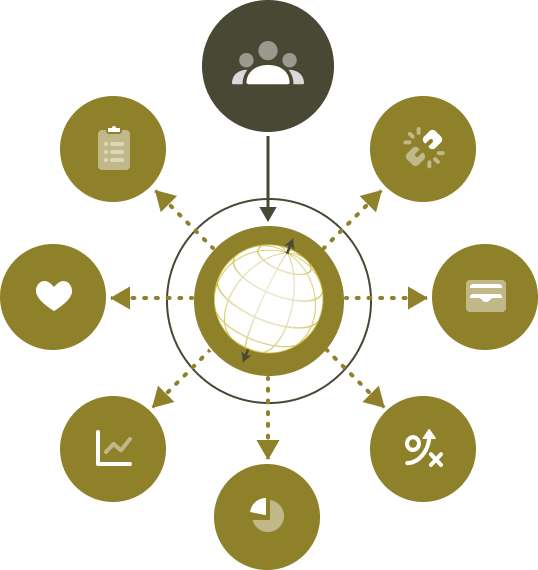

Building Your Team

Creating and executing a successful exit strategy is complicated. We support you with a team to simplify and clarify the process. It starts with understanding your goals. Then building and coordinating your team to optimize your outcomes.

M&A Attorney: An M&A attorney navigates the legal complexities of mergers and acquisitions, ensuring a smooth and compliant transition.

Accountant: An accountant optimizes tax strategies and maintains accurate financial records for informed decision-making.

Wealth Strategist: A wealth strategist aligns your personal financial goals with your business strategy, coordinating across your legal, tax and business teams to optimize your outcomes and help you meet your goals.

Value Consultant: A value consultant assesses and enhances your business’s worth, preparing it for sale or transition.

Investment Banker: An investment banker provides strategic financial advice and facilitates capital raising to support growth or transition.

Personal Coach: A personal coach helps business owners develop leadership skills and create a sustainable succession plan. They also may help you consider your life after you sell or transition the company.

Estate Planning Attorney: An estate planning attorney ensures your wealth is protected and efficiently transferred to heirs according to your wishes.

We Can Help You Answer These Questions

- What is my business worth and why?

- What multiples are standard in my industry?

- Is there a right time to sell?

From The Blog

Helping Business Owners

Check out our latest content aimed at helping all types of business owners reach their goals.

How Do You Determine Your Business Value?

Do you understand what makes your business valuable and how to unlock that value

when you sell?

Small businesses employ over 61.2 million employees, accounting for roughly 46.8% of all employees in the United States of America. Additionally, small businesses make up 99.9% of all private establishments in the United States.

However, 50% of small businesses fail after five years. What causes these businesses to fail? More importantly, how can understanding business value help turn them into significant companies?